- Coinsauce

- Posts

- 10-year Note Yields Surge to 4.5%!

10-year Note Yields Surge to 4.5%!

Welcome back to the Daily Coinsauce Newsletter! Let’s dive into today’s updates—there’s a lot to unpack!

💧Top headlines from the last 24 hours:

• Strategy might sell its Bitcoin holdings if prices drop in the future.

• TLDR of the current economic situation.

📕Educational :

• How bad is the current stock market drawdown?

Lets dive in.

📅 Today

Is Michael Saylor Lying?

A recent rumor suggested that Strategy might sell its Bitcoin holdings if prices drop, citing an April 7 SEC 8-K filing. The disclosure stated:

“As bitcoin constitutes the vast bulk of assets on our balance sheet, if we are unable to secure equity or debt financing in a timely manner, on favorable terms, or at all, we may be required to sell bitcoin to satisfy our financial obligations, and we may be required to make such sales at prices below our cost basis or that are otherwise unfavorable.”

This sparked confusion, though the statement is a standard risk disclosure—not a sign of panic.

While Strategy currently has no plans to sell its BTC, contrary to Michael Saylor’s repeated claims of “never selling,” poor market conditions could eventually force MSTR to liquidate some holdings.

Being aware of this possibility may help investors prepare for a potential black swan event.

Current Economic Situation Explained!

The 10-year note yield surged 10 basis points in a matter of minutes as "reciprocal tariffs" went live.

It's now above 4.50% and 75 basis points above levels seen when the "Fed pivot" began in September 2024.

At this rate, we will have 8% mortgages and a recession by the end of the month.

We now have:

Rapidly rising long-term interest rates

GDP set to decline for multiple quarters

Inflation data back on the rise

Largest wave of tariffs in 100+ years

Consumer sentiment at pandemic-levels

Stock market in a bear market

Talk about a turn of events!

Read more here.

Go Premium

Upgrade Your Experience

Get the full Coinsauce premium experience – featuring exclusive content;

Weekly on-chain insights.

3-5 altcoin chart setups.

In-depth Bitcoin price updates.

Occasional in-depth reports on altcoin gems.

VC funding roundups.

Market cycle insights.

Premium Telegram trading group, and more.

🌎 Other News

📕 Educational

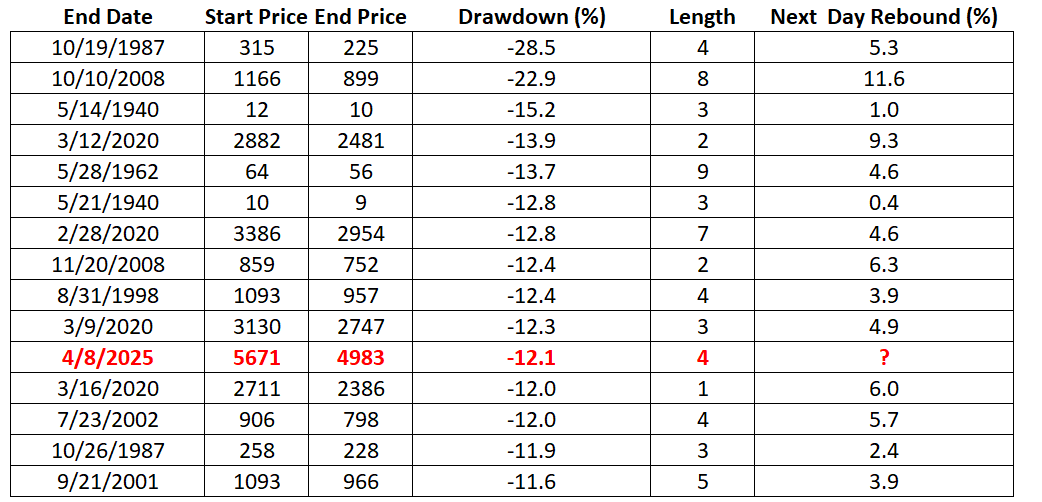

The S&P 500 is currently in its 11th-worst uninterrupted decline since 1940.

Over the past 4 trading sessions, the index has dropped a massive -12.1%.

We are in-line with March 2020, October 2008, and September 2001 drawdowns.

📊 Stat of the day

🤣 Meme of the day

That concludes our update for today!

We appreciate you joining us for the latest news. We aim to provide the best-in-class insights and highlights that keep you well-informed and ready.

Remember to join us on Telegram and Twitter for additional updates and giveaways. Until then, see you next time!

Disclaimer: None of the content shared in the newsletter is financial advice. Always do your own research and analysis before investing.

Reply